Navigating The Landscape Of Online Gaming Income: A Guide To ITR Filing In 2025

Navigating the Landscape of Online Gaming Income: A Guide to ITR Filing in 2025

Related Articles: Navigating the Landscape of Online Gaming Income: A Guide to ITR Filing in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Landscape of Online Gaming Income: A Guide to ITR Filing in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Landscape of Online Gaming Income: A Guide to ITR Filing in 2025

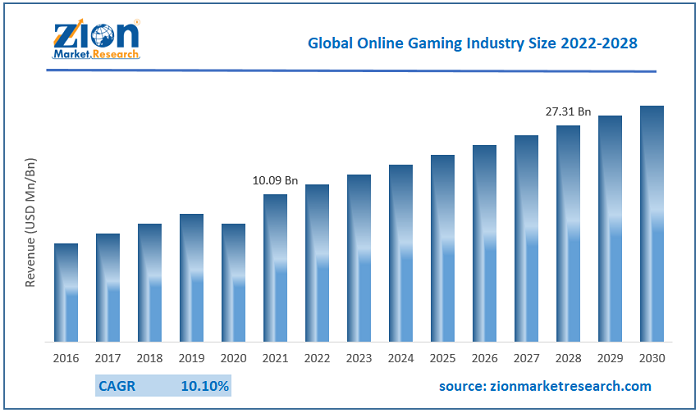

The world of online gaming has evolved into a vibrant and lucrative landscape, with individuals and teams generating substantial income through their digital prowess. As this sector continues to flourish, understanding the tax implications of online gaming income becomes paramount. This guide aims to shed light on the intricacies of ITR filing for online gaming income in 2025, equipping individuals with the knowledge necessary to navigate this evolving tax landscape.

Understanding the Taxable Nature of Online Gaming Income

The income generated through online gaming activities, whether from streaming, esports, or competitive gaming, is generally considered taxable income in most jurisdictions. This income is typically classified as "Income from Business or Profession" under the Income Tax Department’s regulations. The specific classification and tax treatment may vary depending on factors such as the individual’s residency, the nature of the gaming activity, and the platform used.

Key Considerations for ITR Filing in 2025

1. Income Documentation:

- Streaming Platforms: Individuals earning income through streaming platforms like Twitch, YouTube Gaming, or Facebook Gaming should maintain detailed records of their earnings. This includes information on subscriptions, donations, advertisements, and any sponsorships received.

- Esports and Competitive Gaming: Professional gamers participating in tournaments, leagues, or sponsored events need to meticulously document their prize money, sponsorship earnings, and any other forms of compensation.

- Other Sources: Income from other online gaming activities, such as selling virtual items, in-game currency, or providing coaching services, must also be documented.

2. Deductible Expenses:

Taxpayers can claim deductions for expenses incurred in generating their online gaming income. These expenses may include:

- Equipment Costs: This encompasses computers, peripherals, gaming consoles, software, and other necessary equipment.

- Internet and Utilities: The costs associated with internet access, electricity, and other utilities directly related to gaming activities.

- Travel and Accommodation: Expenses incurred for attending tournaments, competitions, or other gaming events.

- Professional Fees: Payments made to coaches, trainers, or other professionals for guidance and support.

- Marketing and Promotion: Expenses related to promoting one’s gaming channel, brand, or services.

3. Tax Filing Process:

- Form ITR-3: Individuals with income from business or profession, including online gaming income, are typically required to file Form ITR-3. This form allows taxpayers to declare their income, expenses, and applicable taxes.

- Tax Rates: The applicable tax rate for online gaming income will depend on the individual’s total income and the tax slab they fall into.

- Tax Deductions and Exemptions: Individuals can claim various tax deductions and exemptions based on their circumstances, such as deductions for investments, health insurance premiums, and charitable donations.

4. Maintaining Records:

It is crucial to maintain meticulous records of all income and expenses related to online gaming activities. These records should be kept organized and readily accessible for tax filing purposes. This documentation can be digital or physical, but should adhere to the Income Tax Department’s guidelines for record-keeping.

5. Seeking Professional Advice:

Navigating the complexities of tax regulations can be daunting. Individuals, especially those with significant online gaming income, should consider seeking professional advice from a qualified chartered accountant or tax consultant. This guidance can help ensure accurate tax filing and minimize potential liabilities.

Frequently Asked Questions (FAQs) on Online Gaming Income and ITR Filing

Q1: Is income from online gaming considered taxable in India?

A: Yes, income earned from online gaming activities, such as streaming, esports, or competitive gaming, is generally considered taxable income in India. This income is typically classified as "Income from Business or Profession" under the Income Tax Department’s regulations.

Q2: What form should I use to file my taxes for online gaming income?

A: Individuals with income from business or profession, including online gaming income, are typically required to file Form ITR-3. This form allows taxpayers to declare their income, expenses, and applicable taxes.

Q3: What expenses can I deduct from my online gaming income?

A: You can claim deductions for expenses incurred in generating your online gaming income. These expenses may include equipment costs, internet and utilities, travel and accommodation, professional fees, and marketing and promotion expenses.

Q4: How do I document my income from streaming platforms?

A: Maintain detailed records of your earnings from streaming platforms like Twitch, YouTube Gaming, or Facebook Gaming. This includes information on subscriptions, donations, advertisements, and any sponsorships received.

Q5: What are the tax rates for online gaming income?

A: The applicable tax rate for online gaming income will depend on your total income and the tax slab you fall into. Refer to the Income Tax Department’s guidelines for the latest tax rates.

Q6: What if I am a minor and earn income from online gaming?

A: If you are a minor, your parents or guardians will be responsible for filing your taxes. The income earned by a minor will be taxed under the parent’s or guardian’s income tax slab.

Q7: Is there a threshold limit for online gaming income before it becomes taxable?

A: The threshold limit for income becoming taxable depends on the specific tax laws of your country. In India, there is no specific threshold for online gaming income. Any income earned from online gaming activities is subject to taxation.

Q8: Do I need to register my online gaming activity as a business?

A: Whether or not you need to register your online gaming activity as a business depends on your specific circumstances and the tax laws of your country. In India, if your income from online gaming exceeds a certain threshold, you may be required to register your activity as a business.

Q9: What happens if I don’t file my taxes for online gaming income?

A: Failure to file your taxes for online gaming income can result in penalties and interest charges from the tax authorities. It is essential to comply with tax regulations and file your taxes on time.

Q10: Where can I find more information about online gaming income and tax filing?

A: You can find detailed information on the Income Tax Department’s website, consult with a qualified chartered accountant or tax consultant, or seek guidance from relevant tax authorities in your jurisdiction.

Tips for Tax Filing for Online Gaming Income

- Maintain Accurate Records: Keep meticulous records of all income and expenses related to your online gaming activities. This documentation will be crucial for tax filing purposes.

- Understand Deductible Expenses: Familiarize yourself with the allowable deductions for online gaming income and ensure you claim all eligible expenses.

- Seek Professional Advice: Consider consulting with a qualified chartered accountant or tax consultant for personalized guidance on tax filing and minimizing potential liabilities.

- Stay Updated on Tax Regulations: Tax laws are subject to change, so stay informed about any updates or modifications that may affect your online gaming income.

- File Your Taxes on Time: Avoid penalties and interest charges by filing your taxes on time, adhering to the deadlines set by the tax authorities.

Conclusion

As the online gaming industry continues to evolve and grow, understanding the tax implications of online gaming income is crucial for individuals seeking to capitalize on this burgeoning sector. By adhering to the guidelines outlined in this guide, individuals can ensure accurate tax filing, minimize potential liabilities, and maintain financial compliance. Remember, proactive tax planning and seeking professional advice are essential for navigating this complex landscape and ensuring a smooth and compliant experience for all stakeholders involved.

![Income Tax Return [ITR] Filing Online - Process, Types of ITR](https://legaltax.in/img/type-of-itr.png)

-online.jpg)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Landscape of Online Gaming Income: A Guide to ITR Filing in 2025. We appreciate your attention to our article. See you in our next article!

You may also like

Recent Posts

- The Evolving Landscape Of Online Gaming In 2025: A Look At Emerging Trends And Innovations

- The Evolving Landscape Of Online Gaming On PS4 In 2025: A Glimpse Into The Future

- The Evolving Landscape Of Free Online Gaming: A Look Into Microsoft’s Vision For 2025

- The Evolution Of Online Slots: Exploring The Landscape Of Free Play In 2025

- The Enduring Charm Of 8-Bit: Exploring Online Retro Gaming In 2025

- The Evolving Landscape Of Free Virtual Games: A Glimpse Into 2025

- The Evolving Landscape Of Online Two-Player Games For Kids: A Look At 2025

- Wordplay In The Digital Age: Exploring The Evolution Of Online Word Games In 2025

Leave a Reply